Global Mindsets Yield Gold Medal Portfolios

With the extinguishing of the Olympic torch, the near-constant attention on the exploits of your home country’s team will start to fade. Having an instinctive home bias towards your own country’s athletes while watching the Olympics is expected and comes with minimal downside risk. Unfortunately, many people have an instinctive home bias in their investment portfolio as well, which comes with greater risks when trying to achieve your financial goals.

Here are four reasons why an international mindset works better for an investment portfolio than the home bias that usually accompanies watching the Olympics:

- Protect the Bottom Line. The primary benefit for investors who own international stocks as part of a diversified portfolio is that over time this can increase returns while reducing risk. The leading guidance indicates that volatility reduction can be accomplished when investment portfolios are comprised of a range of 20-50% in international stocks. Remember, if you lose 50%, you have to earn 100% (double) to make it up. If you only lose 20%, you only have to earn 25% to make it up. Because U.S. & International returns don’t move in the exact same direction at the same time, pairing the two investments together can reduce the magnitude of portfolio downturns, which increases returns and reduces portfolio fluctuations.

- Sector Diversification is Important. A bias towards your home country’s stocks can also skew the diversification of your portfolio across different industries. The U.S. stock market presently has one of the largest concentrations of technology stocks and one of the lowest allocations to cyclical sectors such as consumer discretionary, financials, industrials, energy, and materials. These allocations have been a tailwind for investors owning U.S. stocks in recent years due to the success of tech stocks. But no trend lasts forever. Cyclical stocks tend to do better during economic expansions as consumers increase their consumption. By owning a more globally diversified portfolio, investors can reduce their risk to any individual sector and broaden their portfolio exposure to benefit across different stages of the economic cycle.

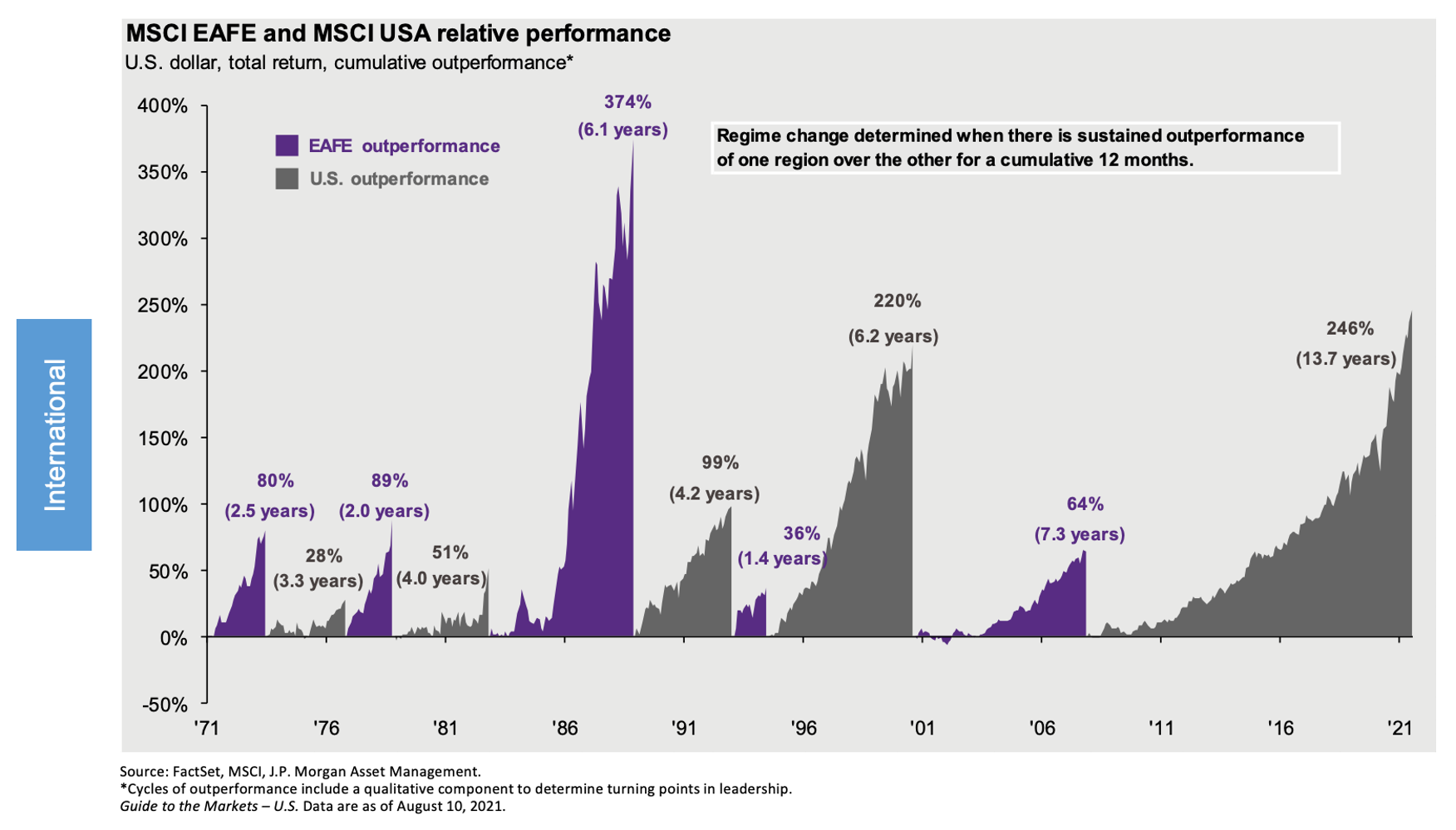

- Outperformance tends to be cyclical. Like most things in life, the relative performance of U.S.stocks compared to international stocks tends to move in cycles. The current period of U.S. outperformance has spanned more than a decade dating back to the Great Financial Recession, which is the longest run of relative outperformance in the past 50 years. During the last cycle of international outperformance “BRIC” stocks were born, a term that was coined to define the surge in performance from emerging markets Brazil, Russia, India, and China. It’s impossible to predict when one cycle will end and another begin, but we know it will happen eventually. If you’ve avoided or minimized international investments in your portfolio, now could be an opportunistic time to gain a better global balance to your portfolio.

- Valuation Matters. Markets can ignore valuations in the short term but in the long run, they tend to be one of the biggest drivers of stock market performance. Whether using valuation metrics such as price-to-earnings ratios or dividend yields, international valuations currently look more attractive than U.S. market valuations. This should come as no surprise when you consider that the U.S. market has outperformed the international market for the better part of a decade. Valuations of international stocks have historically been cheaper than their U.S counterparts but that dispersion is even wider now than in the past.

Watching Olympians perform reminded us that positive results require more than just a knack for doing something, but dedication to the process.

Strategic, long-term investing requires patience and appreciation for the fact that no strategy works all the time. As famed investor George Soros said, “correct investing is painful.” Watching international stocks lag U.S. stocks is tough because it makes us want to run back to our home bias. But by building a balanced portfolio that owns a basket of stocks spread across different industries in different countries, we can increase our chances of achieving our financial goals.

by JOHN FISCHER, CFA®, CFP®

John is the Chief Investment Officer (CIO) at Mosaic Family Wealth. He leads the firm’s Investment Committee which shapes the firm’s investment philosophy and strategy for client portfolios. He also serves on Mosaic’s Leadership Team. A 20-year industry veteran, John is most passionate about helping people understand how emotions relating to investments can be more important than the investments themselves in achieving financial goals.

_______________________________________

Please note that nothing in this content should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account. Nothing in this content is intended to be, and you should not consider anything in this content to be, investment, accounting, tax, or legal advice. If you would like investment, accounting, tax, or legal advice, you should consult with your own accountants or attorneys regarding your individual circumstances and needs.

Mosaic Family Wealth, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Mosaic Family Wealth, LLC and its representatives are properly licensed or exempt from licensure.

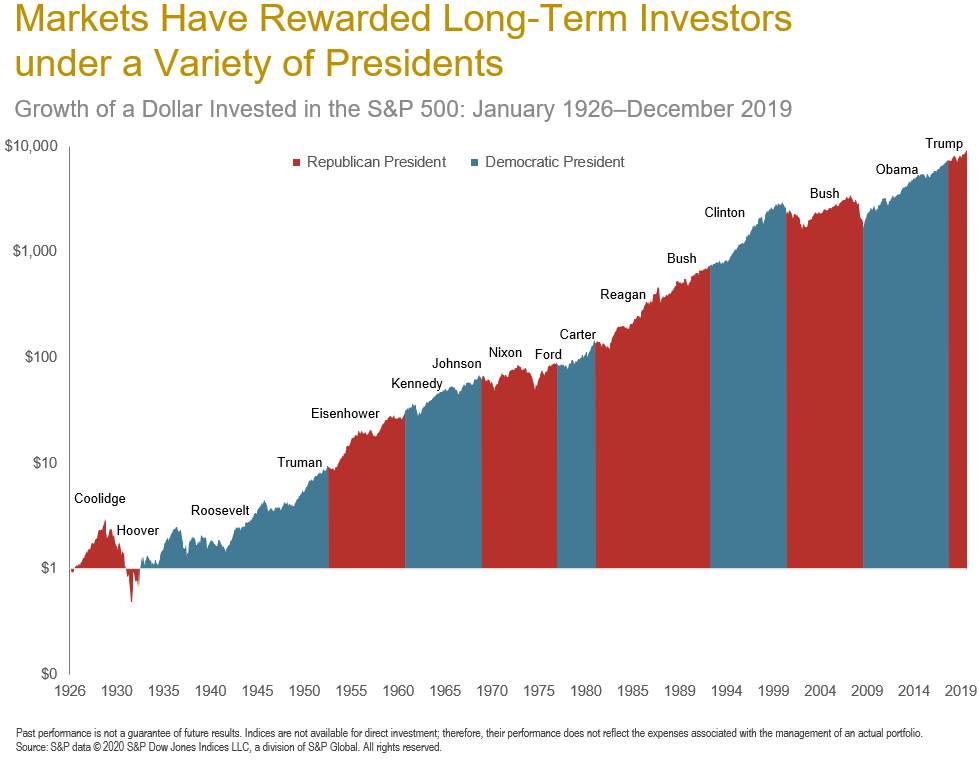

Over the next few weeks leading up to the election, you will see numerous headlines and articles discussing economic scenarios based on the various potential outcomes of the presidential and senate elections. Historically speaking, those outcomes just don’t matter. Ignore them.

Over the next few weeks leading up to the election, you will see numerous headlines and articles discussing economic scenarios based on the various potential outcomes of the presidential and senate elections. Historically speaking, those outcomes just don’t matter. Ignore them.