“The best time to plant a tree was 20 years ago. The second best time is now.”

Chinese Proverb

“Each success only buys an admission ticket to a more difficult problem.”

Henry Kissinger

Summary of Services

At Mosaic Family Wealth, we help our clients move from a life of success to a lifetime of significance.

As your family wealth coach, we will tailor our resources to best address your needs including:

- Retirement Income Cash Flow Planning

- Investment Management

- Advisor Coordination

- Tax Planning Services

- Estate Planning

- Specialty Areas: business strategy, exit planning, executive compensation and family leadership.

Leonardo Da Vinci

Clarify. Simplify. Amplify.

Money is important…it touches every aspect of our lives, impacting the decisions we make and the stories we tell. But some things are more important than money. Things such as family, friends, experiences and legacy. These are the reasons we are dedicated to guiding you through life’s complex financial issues, leaving you free to focus on areas that bring lasting significance.

Take a moment and ask yourself:

- How much is enough?

- How do I define security? Do I have it?

- Am I confident my family will be taken care of should something happen to me?

- Financially speaking, what am I anxious about? What is robbing me of time and joy?

- If I am in a position of abundance, how much should I keep?

- In what ways should wealth impact my family, relationships, experiences, and legacy?

At Mosaic Family Wealth, our mission is to help you accomplish your financial goals. We believe the keys to financial success are proper planning and behavior.

Clients call us first to discuss financial strategies for any situation involving a dollar sign.

Honesty is our priority, even when it may be difficult to hear.

The bottom line:

We strive to

- Clarify your goals

- Simplify the path to reaching them

- Amplify what you can accomplish.

Investment Philosophy

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has ever been lost in corrections themselves.”

Peter Lynch

Mosaic Family Wealth uses an evidence-based, academically researched approach to create long-term, diversified portfolios to help clients achieve their unique financial goals, needs, and objectives.

A Different Approach

Robert Schuller

Our newest clients often talk about challenges they’ve faced in the market—how the downturn of 2008 shook their confidence as investors, or how a “sure thing” suddenly became anything but.

Our response is to listen, empathize, and educate.

The truth is that the markets will always be unpredictable; losses and gains happen, and they are largely out of anyone’s control. In fact, vast amounts of academic research have proven time and again that there is virtually no way of predicting when significant market events will occur.

Watch our video, “Do Unicorns Exist?” to learn more.

Understanding Markets Starts with Understanding Human Behavior

Andy Stanley

Instead of focusing on what we can’t control, we help you focus on what you can: yourself. Our investment philosophy is grounded in the study of human behavior, so you can better understand your own actions and reactions to market forces.

Viewing the market through the lens of behavior demonstrates that it is more favorable to be generally correct as an investor with a long-term focus than to be precisely wrong as an investor with a solely short-term focus.

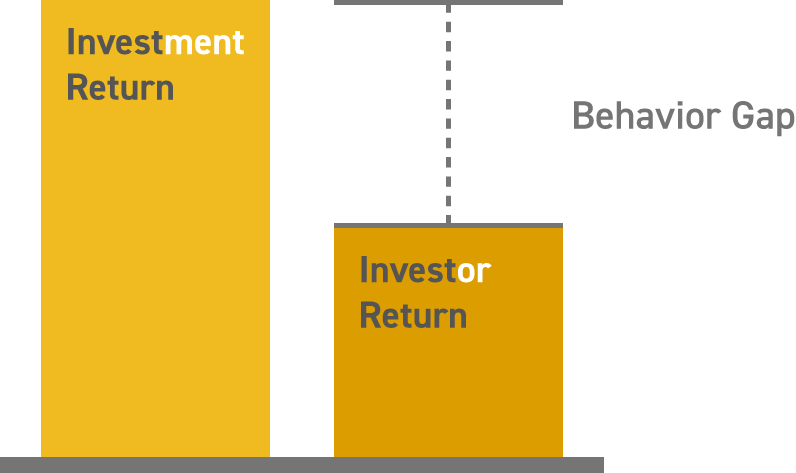

Behavior Gap

John Maynard Keynes

Financial author and strategist Carl Richards’ extensive studies on individual investors have returned the same findings: human behavior is routinely the worst enemy of our investment portfolios. To be more precise, these studies show that many investors significantly underperform the markets they invest in due to their inability to control certain behaviors.

We call the difference between the market’s investment return and an investor’s actual return “The Behavior Gap.”

Instead of following a disciplined, long-term strategy—one modeled on a well-diversified portfolio built to deal with the market’s natural ups and downs over time—individual investors tend to make two crucial behavioral mistakes:

- They try to time the market.

- They rely too heavily on specific stocks or sectors, exposing themselves to undue risk.

Illustrations presented through license from author Carl Richards of BehaviorGap.com.