The Elephant in the Room

There’s no need to beat around the bush: prices are higher. We’re reminded every time we fill up our gas tanks, where prices have risen by 50% over the last year. We see it at restaurants where a lack of workers leaves tables empty and menu prices have risen to fuel the higher wages needed to attract employees. If you booked a summer vacation, you felt the higher prices as hotel, car rentals, and airline prices have all risen. Bought a house or a car recently? You’ve certainly felt the pain of higher prices as well.

Investors don’t have to look far to see that prices have risen. Last year, prices for many goods were artificially suppressed due to the government-induced coma on the economy thanks to the global pandemic. That means inflation is higher in 2021 in part simply because it is being compared to abnormally low 2020 prices. Increased consumer demand as the economy has awoken from its pandemic slumber has also put upward pressure on prices along with supply constraints (like the shortages in semiconductor chips & labor we are seeing, and higher prices in inputs such as lumber and energy). Add it all up and it’s not surprising that inflation is running higher right now. All of this raises the question: should investors be worried about inflation?

The Trillion Dollar Question. Is the current elevated inflation a temporary phenomenon (“transitory” in Fed speak) or a more persistent, longer-term issue for the economy? More importantly, why does it matter?

Consider a restaurant that normally serves 50 customers per night. But in the past 2 weeks, they’ve serviced 75 customers nightly. Would you suggest the restaurant substantially increase its staffing and food on hand due to the recent surge in demand? If the business pick-up is only temporary, the restaurant risks losing money due to raising its input costs. If the demand is more persistent and the restaurant doesn’t increase its food and labor supply, the restaurant risks losing business because it lacks enough resources to serve the additional customers. The Fed is trying to answer a similar question with inflation – if it’s temporary, then they shouldn’t overreact with a knee-jerk reaction, but if it’s not temporary then they need to look at taking action to curb inflation sooner than later.

We have seen some signs that inflation is possibly moderating as monthly inflation figures are off their highs from earlier in the summer. If you look at the level of annualized price increases over a two-year timeframe, as opposed to using 2020 depressed price levels, inflation levels start looking less elevated as well. The dramatic price increases in certain portions of the economy due to supply chain disruptions are pulling overall inflation figures higher, though they’re likely to be more short-lived. In our view, we believe that current inflation levels are more temporary in nature, but that inflation will be modestly higher for some time. Investors should be cautious when attempting to predict future inflation as this unique economic environment was created by the worst global pandemic in a century. Comparisons to past market cycles aren’t likely to be highly instructive during present circumstances.

The cost of getting too cute. During the Great Recession of 2007-09, hedge funds fared relatively well in helping high net worth investors reduce their losses. In the years that followed, a new asset class was born called liquid alternative investments that were pitched to all investors as a product that would offer downside protection and enhance portfolio returns over the long term. The implication was that the typical portfolio of stocks and bonds no longer worked, and investors needed to think differently if they want to avoid the next market drop.

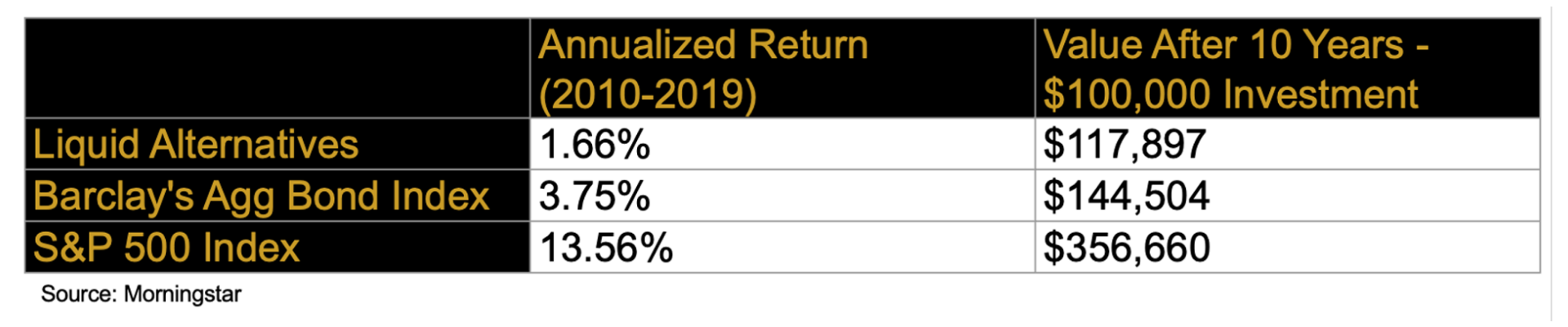

From 2010-2019, the median performance of liquid alternative funds was 1.66% per year. Over that same timeframe, the S&P 500 returned 13.5% per year and the Barclays Aggregate Bond Index returned 3.75% per year. If you shifted a portion of your fixed-income allocation to liquid alternatives, you lost 2% per year. If you shifted a portion of your equity portfolio, it cost you nearly 12% per annum. Investors paid dearly for trying to get too cute. Remember that staying the course, not repeatedly shifting your portfolio, and playing the long game IS a strategy – a time-tested successful one at that.

What’s the best hedge for inflation? For fixed-income portfolios, the best hedge for inflation is owning Treasury Inflation Protected Securities (TIPS). TIPS are bonds issued by the US government. Total return will likely not be much better than inflation, but TIPS will keep up with inflation. In general, the best portfolio hedge to inflation over time has been owning a diversified basket of stocks. Since 1970 alone, the cost of goods has increased roughly seven-fold in the U.S. Over the same 50 years, the S&P 500 index has increased by more than 40 times. This serves as a reminder for investors of the importance of seeing the equity forest through the inflation trees.

What’s the best hedge for inflation? For fixed-income portfolios, the best hedge for inflation is owning Treasury Inflation Protected Securities (TIPS). TIPS are bonds issued by the US government. Total return will likely not be much better than inflation, but TIPS will keep up with inflation. In general, the best portfolio hedge to inflation over time has been owning a diversified basket of stocks. Since 1970 alone, the cost of goods has increased roughly seven-fold in the U.S. Over the same 50 years, the S&P 500 index has increased by more than 40 times. This serves as a reminder for investors of the importance of seeing the equity forest through the inflation trees.

You don’t have to look long or hard to notice that prices are running higher right now. How long they remain elevated and when they subside as we return to a more normal economic environment is the magic eight-ball question. Rather than trying to predict the unpredictable, long-term investors can protect their portfolios from the uncertainties of inflation and silence the elephant in the room by owning a balanced portfolio of stocks as part of a diversified portfolio.

_______________________________________

Please note that nothing in this content should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account. Nothing in this content is intended to be, and you should not consider anything in this content to be, investment, accounting, tax, or legal advice. If you would like investment, accounting, tax, or legal advice, you should consult with your own accountants or attorneys regarding your individual circumstances and needs.

Mosaic Family Wealth, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Mosaic Family Wealth, LLC and its representatives are properly licensed or exempt from licensure.