Quality Questions Yield a Quality Life

It’s been said that quality questions create a quality life. Successful people ask better questions, and as a result, they get better answers. With better answers, they are better equipped to solve the problems or pursue the opportunities that lie in front of them on their path toward a life of significance.

With the stock market down more than 20% for only the second time in nearly 15 years, anxious investors are naturally starting to ask more questions. It’s in these times of worry that the quality of our questions becomes even more important because our emotions like to hijack our ability to reason. Here are some quality questions and answers investors should be discussing with their advisors.

Just how bad is it?

The first half of the year has seen a confluence of events that we really haven’t seen before – four-decade high inflation, war, a pandemic, Fed tightening, supply chain issues, and labor shortages. The combination of these economic and geopolitical challenges has driven the stock market into its longest bear market since 2008, while bonds have suffered a double-digit decline for the first time in decades. If the S&P 500 closed the year at its current level, it would be its sixth-worst year ever. With stocks and bonds both down year to date, it feels like there’s been no safe haven for investors. If you’re feeling uneasy, it’s understood. We haven’t experienced losses this severe for this length of time for well over a decade.

Despite this heavy dose of negative reality, the market outlook is not all doom and gloom when considering market fundamentals. There are many bullish indicators for our economy that give us hope:

- Job openings remain near an all-time high1

- Unemployment is near a 50-year low

- Household debt as a percentage of income is at a 40-year low

The average U.S. consumer balance sheet remains healthy. Adding more hope to our outlook is the expectation that corporate earnings should grow by 10% for 2022, in line with the market’s long-term earnings growth rate.2

Is this market decline different?

It is and it isn’t.

Yes, this bear market is different than previous ones caused by events that are unique to this time we are living in. Not many saw a prolonged war coming in Ukraine, or expected global supply chain issues, both of which are contributing to our inflation woes that have pushed us into a bear market.

But it’s really a swap of one set of unknowns for another which makes this bear market similar to others. No one knew when tech stocks bubble would bottom, the housing market would end its freefall, or when the 2020 pandemic-induced market decline would cease.

Looking back at previous bear markets, none of them looked exactly like the one we are experiencing. But no two bear markets are exactly the same.

How do market returns look following bear markets?

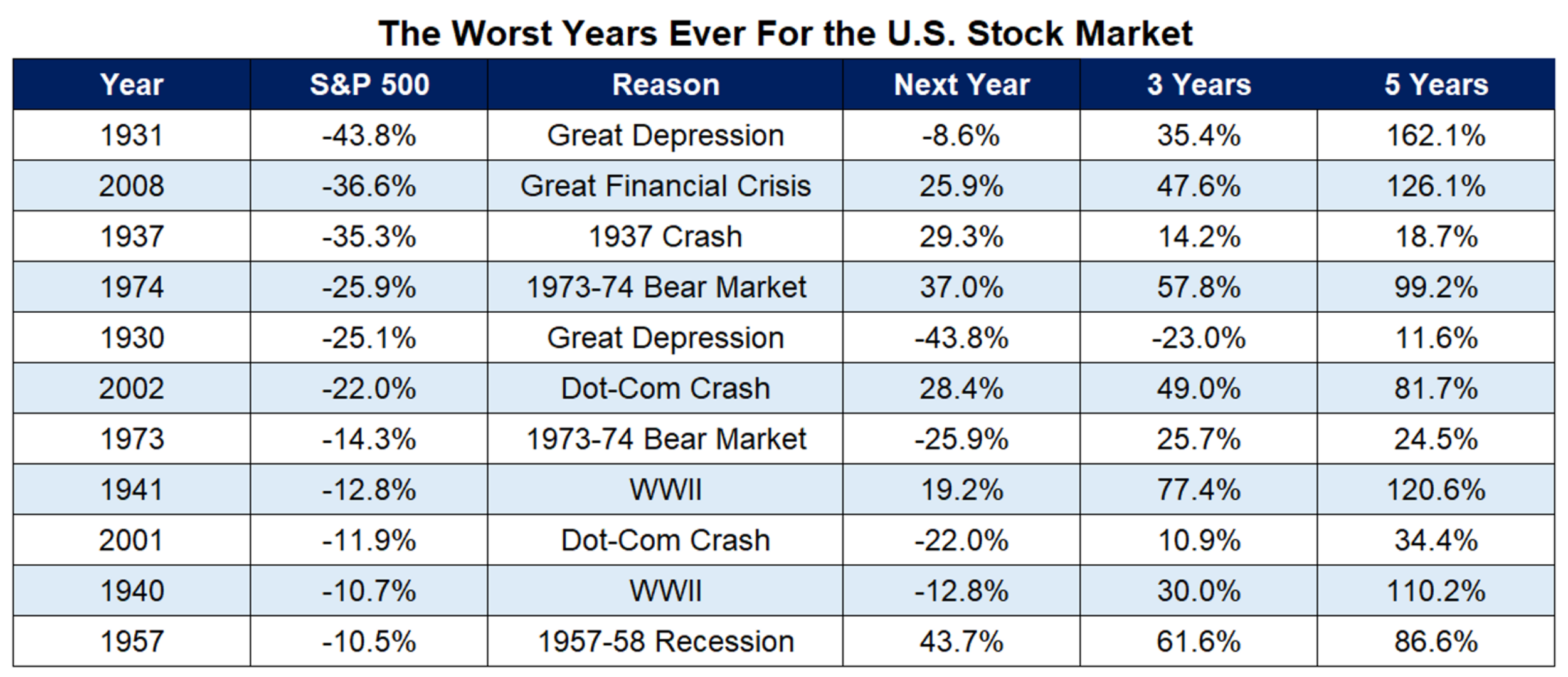

With the S&P 500 down more than 20%, the bear market is already here. It’s a sunk cost. So, let’s look forward to what investors might expect moving forward. Analyzing eleven instances when the U.S. stock market suffered a double-digit yearly loss provides some important insights that investors should note about future returns following the worst years:

- 1-year returns were positive 6 of 11 times while averaging just over a 6% return

- 3-year returns were positive in all but one case during the Great Depression with an average cumulative return of 35%, or 10.5% annualized return

- 5-year returns were positive 100% of the time with an average cumulative return of almost 80%, or 12.4% annualized return3

While the current market environment has left many investors a bit unnerved, history suggests there’s plenty of reason for long-term investors to feel hopeful when considering future market returns.

What actions should I be taking right now?

Investors would be wise to start by asking their advisor quality questions. Avoid questions that can’t be known, such as how long will this market decline last or how far will stocks fall. Instead, ask your advisor if your financial plan is still on track to achieve your goals? Ask if market declines like this one are factored into the plan that was created for you? Depending on your goals, ask your advisor if you have the right investments in your portfolio to keep pace or outpace inflation? By asking these quality questions about your financial plan, investors focus on what they can control, which is a key to creating quality outcomes.

Given the market volatility, another area of control for investors is the balance of their portfolios. Spend time strategizing with your advisor to make sure you own the right allocation of stocks and bonds aligned to your comfort with risk and the milestones you have set for your investment portfolio.

The solid returns following the worst years ever for the U.S. Stock Market should serve as a good reminder for long-term investors with cash on the sidelines to consider a plan that puts their money to work.

What actions should I avoid right now?

In times of turmoil, humans have a tendency to trade in their plans for panic. That’s why when America was first sending astronauts to space, the primary skill they were trained on was the art of not panicking. Panic causes people to ignore rules, make mistakes, and deviate from well-crafted plans.

Investors could learn a lesson or two from astronauts.

- First: Trust your plan. Your advisor has worked with you to develop a financial plan that is well-constructed and meticulously developed to help you achieve your goals over time. Even so, during times of market chaos, it’s hard to ignore that tingling feeling urging us to throw it all out the window. It’s why Warren Buffett once said, “investing is simple but not easy.” It’s not easy because it takes discipline. Disciplined investors have been rewarded time and again by staying the course with their plans after market declines.

- Second: Remain calm. Investors should stay focused on what they can influence, not worry about what they can’t control. Investment advisor Charley Ellis makes this point clear: “Forecasting the future of any variable is difficult, forecasting the interacting futures of many changing variables is more difficult, and estimating how other expert investors will interpret such complex changes is extraordinarily difficult.” Often, understanding what you don’t (or can’t) know is more valuable than what you do know.

Investors should be wary of anyone predicting when this market slide will end or when some of the current market factors such as war and high inflation will subside. These are unknowns that simply can’t be answered in the present.

How do I navigate this market decline?

While the current market storm has left investors understandably unsettled, we’d encourage long-term investors to remember that we’ve been through these types of worrisome markets before. While no one likes the recent volatility, it is the tradeoff investors make for returns over time that far exceed cash.

During past steep market declines, we’ve helped our clients successfully navigate these unchartered waters by focusing on what they can control, avoiding panic, asking quality questions, and sticking to their plans. Speaking of quality questions, what do lower stock prices mean for long-term investors? It means higher future expected returns. That’s a quality answer investors should appreciate.

Now is a good time to reach out to your financial advisor for a meaningful quality question and answer session.

Sources: 1 https://tradingeconomics.com, 2 Factset, 3 awealthofcommonsense.com, Mosaic calculations

by JOHN FISCHER, CFA®, CFP®

John is the Chief Investment Officer (CIO) at Mosaic Family Wealth. He leads the firm’s Investment Committee which shapes the firm’s investment philosophy and strategy for client portfolios. He also serves on Mosaic’s Leadership Team. A 20-year industry veteran, John is most passionate about helping people understand how emotions relating to investments can be more important than the investments themselves in achieving financial goals.

_______________________________________

Please note that nothing in this content should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account. Nothing in this content is intended to be, and you should not consider anything in this content to be, investment, accounting, tax, or legal advice. If you would like investment, accounting, tax, or legal advice, you should consult with your own accountants or attorneys regarding your individual circumstances and needs.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

Past performance shown is not indicative of future results, which could differ substantially. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss, and the reinvestment of dividends and other income. You cannot invest directly in an Index.

Mosaic Family Wealth, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Mosaic Family Wealth, LLC and its representatives are properly licensed or exempt from licensure.

SHOULD BITCOIN BE CONSIDERED A CURRENCY?

SHOULD BITCOIN BE CONSIDERED A CURRENCY?

by MISSY BROWN, CFP® CPWA®

by MISSY BROWN, CFP® CPWA®